After a holiday party discussion about when certain commodities go on sale, I got a hankering to collect real data to back up my intuition. Oh, and I have intuition. For instance, baking commodities - flour, butter, cake mixes - go on sale during Thanksgiving week, early December and, to a lesser extent, around Easter. This seems counter-intuitive in that the stores clearly know that people concentrate their baking around these dates. Wouldn't it be wise to jack up prices? Apparently, they believe that price elasticity also goes up along with the baking impulse. They need to force the vague thought about baking into action by enabling us to save x percent on pumpkin filling.

Perhaps less well known is that Chex go on sale before the super bowl. Why? Chex mix. Same reason as above.

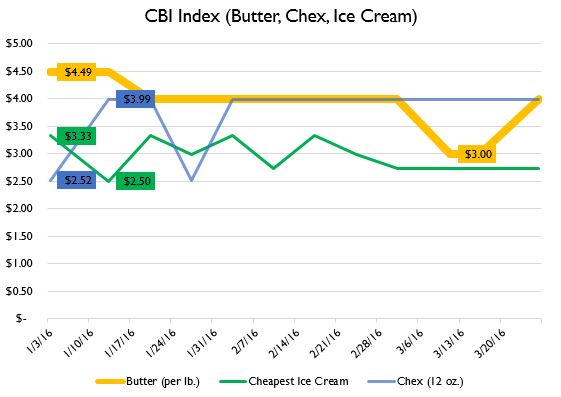

So, on my shopping trips this year, I chose three items - store brand butter, Chex and the cheapest ice cream - and monitored prices at my grocery store, which is the rust belt Appalachian powerhouse Giant Eagle. Below are the trends in the inaugural CBI (Chex, Butter, Ice Cream) Index, with high and low prices marked. Note the Chex super bowl dip and the Easter butter dip.

Butter averaged $3.91 per pound. Chex averaged $3.75 for a standard 12-ounce box of gold-standard Corn Chex. The cheapest ice cream (er, frozen dairy dessert - why?) averaged $2.96 per 1.5 quart.

Here are the first quarter trends:

Also, for anyone interested in the trend of what ice cream brand was cheapest week to week, here's that data:

6 years ago